Seriously! 45+ List About Cash To Income Ratio They Did not Share You.

Cash To Income Ratio | Quick ratio = $100,000/$110,000 = 0.91. 9 external financing index ratio. Financial ratios can be classified into ratios that measure: Cash ratio is a refinement of quick ratio and indicates the extent to which readily available funds can pay off current calculation: Using cash flow as opposed to net income is considered a cleaner or more accurate measure since earnings are more easily manipulated.

It's useful because it tells you how much money a firm made in an accounting period from the ebit itself amounts to the net annual income, plus interest expenses, plus income tax expenses. A cash flow ratio can be used in addition to traditional net income accounting ratios to provide useful comparative information about a business. Financial ratio analysis is performed by comparing two items in the financial statements. Depreciation and amortization are the most common examples, and these income statement expenses reduce net income but have no effect on cash flow, so they must be added back. This ratio serves as evidence that mattel's cash position improved from the end of 2011 to the end of 2012.

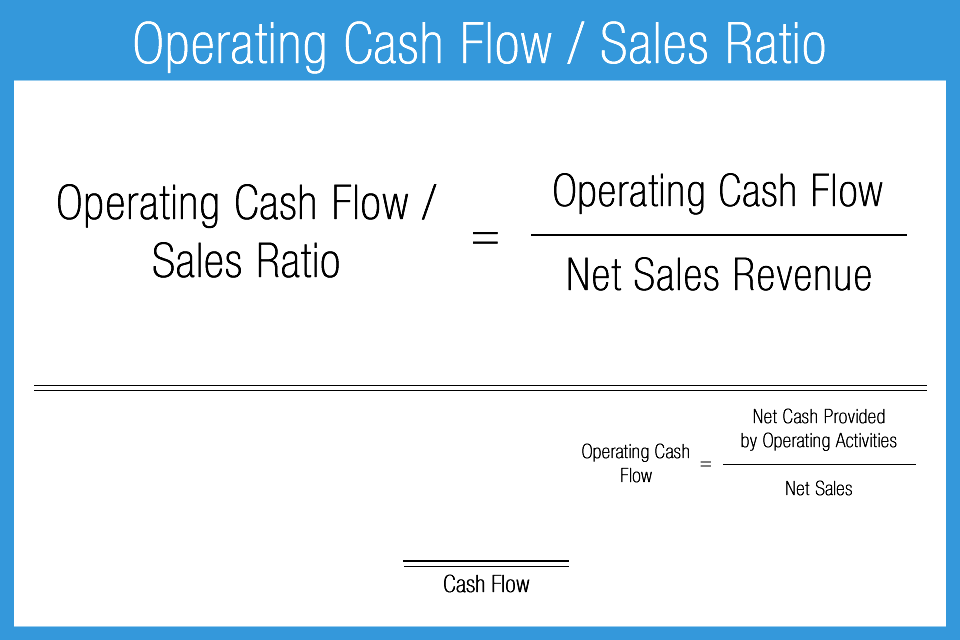

8 cash generating power ratio. The cash ratio or cash coverage ratio is a liquidity ratio that measures a firm's ability to pay off its current liabilities with only cash and cash equivalents. To calculate the net income for a company, you will need to subtract the total expenses from revenue. Total income generated by a company. For example the amount of depreciation and bad debt allowance. It's useful because it tells you how much money a firm made in an accounting period from the ebit itself amounts to the net annual income, plus interest expenses, plus income tax expenses. Cash to income ratio is a cash flow ratio which measures dollars of cash flows from operating activities per dollar of operating income. The resulting ratio can be interpreted in a way that is more insightful than looking at the items separately. When the company has all the details mentioned in the cash flow statement below formula is used and for. Under current liabilities, the firms would include accounts payable, sales taxes payable, income taxes payable, interest payable, bank. Its cash position worsened because less cash came into the company from inventories and more went out in accounts payable. Quick ratio = $100,000/$110,000 = 0.91. A performance ratio measured by fbility to generate cash from firm operations.

The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a company's operations. Compared to other liquidity ratios such as the current ratio and quick ratio, the cash ratio is a stricter. Cash to income ratio is a cash flow ratio which measures dollars of cash flows from operating activities per dollar of operating income. The cash ratio is much more restrictive than the current ratio or quick ratio because no other current assets can be used. The resulting ratio can be interpreted in a way that is more insightful than looking at the items separately.

10 cash flow ratios summary. Net income is a subjective measure which is based on accounting principles and opinions; Most of the firms show cash & cash equivalent together in the balance sheet. When the company has all the details mentioned in the cash flow statement below formula is used and for. To calculate the net income for a company, you will need to subtract the total expenses from revenue. Operating income roughly equals earnings before interest and taxes. Reconciling net income to operating cash flow involves adding or subtracting these noncash items. The cash ratio or cash coverage ratio is a liquidity ratio that measures a firm's ability to pay off its current liabilities with only cash and cash equivalents. In financial accounting, operating cash flow (ocf), cash flow provided by operations, cash flow from operating activities (cfo) or free cash flow from operations (fcfo). It is calculated by dividing cash flows from operations by the operating income. Using cash flow as opposed to net income is considered a cleaner or more accurate measure since earnings are more easily manipulated. Cash ratio is a refinement of quick ratio and indicates the extent to which readily available funds can pay off current calculation: Risk weighted assets mean fund based assets such as cash, loans, investments and other assets.

Total income generated by a company. Risk weighted assets mean fund based assets such as cash, loans, investments and other assets. The cash ratio or cash coverage ratio is a liquidity ratio that measures a firm's ability to pay off its current liabilities with only cash and cash equivalents. In financial accounting, operating cash flow (ocf), cash flow provided by operations, cash flow from operating activities (cfo) or free cash flow from operations (fcfo). Operating income roughly equals earnings before interest and taxes.

Degrees of credit risk expressed as percentage. This ratio serves as evidence that mattel's cash position improved from the end of 2011 to the end of 2012. On paper, and at the top of the financial statement, it. Depreciation and amortization are the most common examples, and these income statement expenses reduce net income but have no effect on cash flow, so they must be added back. Quick ratio = $100,000/$110,000 = 0.91. Cash and cash equivalents / current liabilities. 9 external financing index ratio. Financial ratios can be classified into ratios that measure: Operating income roughly equals earnings before interest and taxes. When the company has all the details mentioned in the cash flow statement below formula is used and for. For example the amount of depreciation and bad debt allowance. Reconciling net income to operating cash flow involves adding or subtracting these noncash items. The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a company's operations.

Cash To Income Ratio: For example the amount of depreciation and bad debt allowance.

Source: Cash To Income Ratio

0 Response to "Seriously! 45+ List About Cash To Income Ratio They Did not Share You."

Post a Comment